Balfour Beatty raises share buyback scheme to £150 million

Balfour Beatty is raising its share buyback scheme to £150 million and reinstating its dividend after recording underlying yearly profit of £25 million in 2020, down from £186 million in 2019.

Its order book increased by 15% to £16.4 billion - led by the UK, with £6.4 billion - and the company aims to go "beyond net zero carbon" by 2040, claiming it has more than halved its carbon intensity since 2010. The board has recommended a final dividend of 1.5 pence, compared with 2.1 pence in 2019.

Leo Quinn, Balfour Beatty Group Chief Executive, said throughout the pandemic, it has protected the Group’s strengths, supported stakeholders and held firm to its disciplines.

"Our leading positions in large growing infrastructure and construction markets, record year end order book and £1.1 billion Investments portfolio provide confidence in future cash generation," he said. "This underpins our new capital allocation framework which demonstrates Balfour Beatty’s commitment to deliver enhanced returns to shareholders."

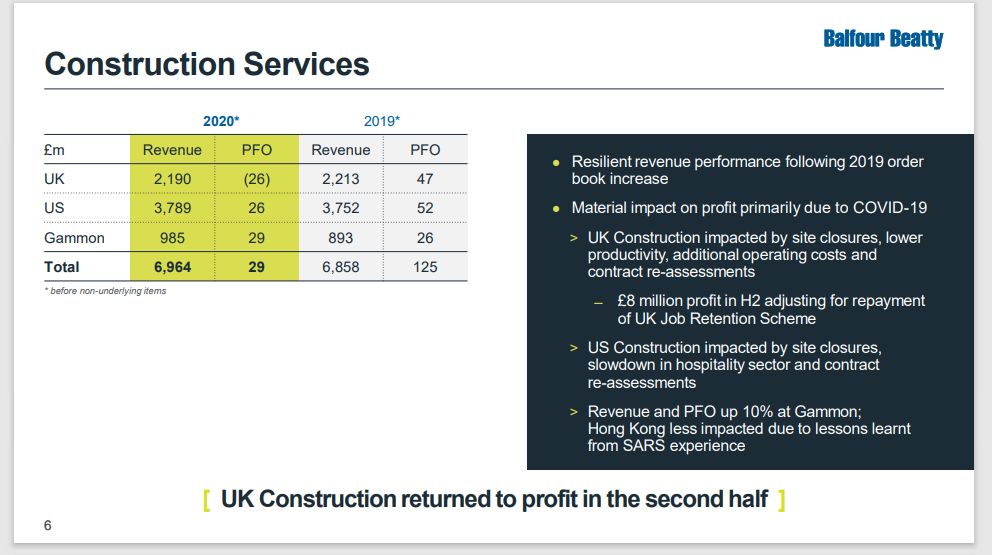

Figures for its Construction Services are listed below.

It believes the UK's 'lower risk order book' underpins future returns.

Its infrastructure investment pre-tax profit dropped to £20 million, compared with £98 million in 2019, but it maintains "leading positions in the UK, US and Hong Kong". It will "recommence asset disposals" in 2021 and is predicting a strong outlook, in line with 2019.

Balfour Beatty's drive for digital productivity over the last five years was also included in the results presentation.

Last month, for the second year running, Balfour Beatty secured top spot in the Heavy Construction category in Britain’s Most Admired Companies 2020 Awards.

- Are there untapped opportunities for construction in the UK?Built Environment

- HS2 trials innovative technology to cut carbon by 10%Technology & AI

- HS2: 2-year construction is set to last even longerConstruction Projects

- HS2: Construction shake-up as main contractor changesConstruction Projects